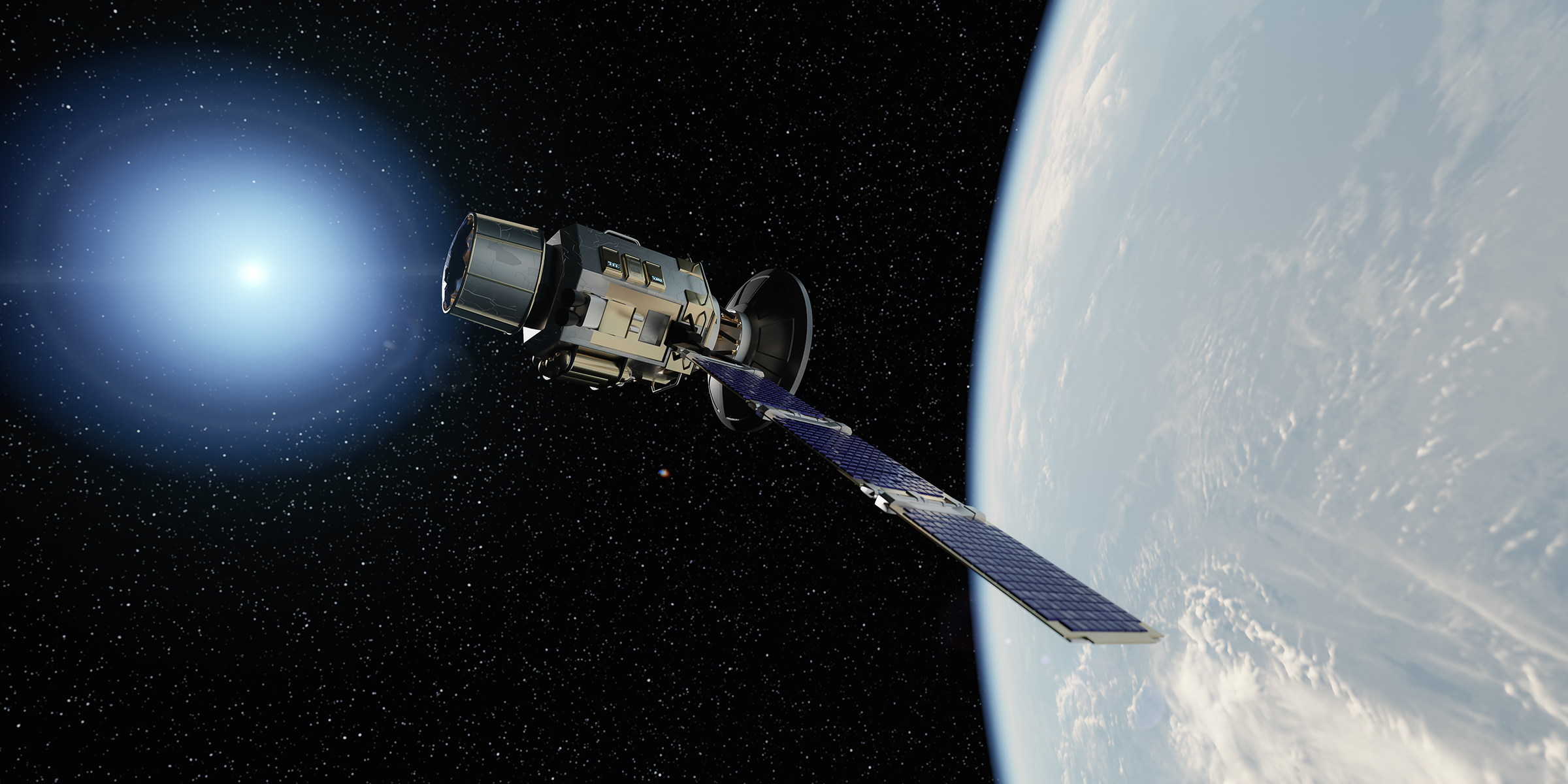

It’s time to venture into space. With coverage and revenue streams plateauing, communication service providers (CSPs) are broadening their horizons—literally as well as figuratively—to explore the satellite telecommunications market.

Government regulators establish mobile coverage requirements for CSPs to provide widespread coverage. And although global coverage continues to improve, a sizeable chunk of the world’s population still doesn’t have access to fast (3G/4G) mobile broadband. In fact, according to the Global System for Mobile Communications (GSMA), “satellite is the only realistic means of reaching the 7% of the world outside of mobile network coverage.”

Expanding into satellite networks is a promising growth opportunity. According to Analysys Mason, “telcos that rely exclusively on terrestrial networks will miss revenue opportunities and fall behind their rivals.” NSR (an Analysys Mason company) predicts that satellite solutions will account for 40% of the growth in telco enterprise connectivity revenue between now and 2027.

Now is the time for CSPs to develop a satellite strategy—one that will help them succeed and differentiate in a market projected to be worth $146B in 2032.

Satellite Networks: An Out-of-This-World Connectivity Solution

Satellite networks, a type of non-terrestrial network (NTN), use Geostationary Equatorial Orbit (GEO), Medium Earth Orbit (MEO) and Low Earth Orbit (LEO) satellites to function as relays, extending the coverage and capacity of terrestrial networks. By using a mix of LEO, MEO and GEO satellites, satellite providers can:

- Serve high-throughput and low-latency connectivity.

- Reach remote areas.

- Provide backup/redundancy to terrestrial networks.

- Support 5G networks, private 5G and Internet of Things (IoT) tracking.

Beyond the Bulky Brick: The Satellite Revolution

Forget the bulky satellite phones of the past. Satellite technology has undergone a dramatic transformation, opening new doors for CSPs and users. Recent advancements, like LEO constellations (e.g., Starlink) and software-defined satellites, have unleashed a wave of improvements:

- Soaring bandwidth and lower latency: Say goodbye to slow connections. Satellite services now offer significantly higher bandwidth and reduced latency, making them ideal for real-time applications and data transfers.

- Cost-effective connectivity everywhere: Connecting remote mobile base stations via satellite backhaul is now a viable alternative. Technological advancements, lower infrastructure costs and adoption of 3GPP standards have paved the way for affordable solutions. This allows for satellite integration with IoT devices, delivering ubiquitous communication.

- Easier adoption and integration of satellite services: The development of ‘satellite-as-a-service’ solutions and the emergence of common standards in the satellite and telecoms markets are making it easier for mainstream CSPs to integrate satellite services.

- Smarter satellite phones: Satellite phones aren’t new. Iridium, the company that launched the first satellite phone in 1999, provided service to 397,000 commercial voice and data subscribers at the end of 2022. But traditional satellite handsets are expensive and don’t look or function like a smartphone. Fortunately, that is changing. Space companies are developing satellites that can communicate directly with existing smartphones, and smartphone companies are adding relatively inexpensive chips that allow the phones to talk directly with satellites.

Big Payoffs for CSPs That Integrate Satellite into Their Networks

Satellites are no longer a futuristic vision—they’re a key player in the evolving landscape of connectivity. Here’s why CSPs can’t afford to ignore them:

Analysys Mason reports that satellite connectivity is a rare bright spot, experiencing growth even as terrestrial spending declines. They predict a staggering USD5 billion increase in satellite revenue between 2022 and 2027.

Integration with satellite networks unlocks a massive $147B in revenue opportunity for CSPs by 2032 (Analysys Mason). This includes a projected USD32.5 billion growth in satellite-related revenue for telcos between 2022 and 2027.

Pioneering 5G Innovation:

Juniper Research predicts operators will generate a staggering $17B in additional revenue from 5G satellite networks by 2030. The first commercial launch is expected in 2024, with over 110 million 3GPP-compliant connections operational by 2030.

Bridging the Gap: How Satellites Empower CSP Networks

Satellites are becoming a game-changer for CSPs looking to expand their reach and provide a robust user experience. Here’s how:

- Eliminating coverage gaps: Traditional terrestrial networks often struggle in remote areas, mountainous regions or densely built-up environments. These limitations create “coverage gaps” where users experience weak or nonexistent signal. Satellites bridge these gaps by offering ubiquitous coverage, enabling CSPs to reach previously unconnected populations and fulfill coverage obligations.

- Reaching underserved areas: Building and maintaining terrestrial infrastructure in rural or sparsely populated regions is expensive, making it difficult to extend coverage. Often, CSPs rely on government grants, like the UK’s Shared Rural Network program. Satellite solutions provide a cost-effective alternative, allowing operators to extend mobile broadband and connect households in remote locations that terrestrial networks simply can’t reach.

- Boosting network capacity and resilience: With the ever-increasing demand for data, terrestrial networks can become congested. Satellites can alleviate this pressure by “offloading” data traffic, effectively increasing network capacity. Additionally, satellite infrastructure provides an extra layer of redundancy, making networks more resilient in case of terrestrial outages. This ensures continuous connectivity for critical applications and services.

Charting Your Course: Satellite Strategy Options for CSPs

The future of connectivity is increasingly intertwined with satellite technology. Analysys Mason urges CSPs to leverage satellites to enhance existing services and enter new markets. Here are key strategies to consider:

Organic growth:

Leverage existing expertise. CSPs with established infrastructure can expand their broadband offerings. For example, Orange now includes satellite internet, providing a “superfast” solution (200 Mbps download) for customers outside fiber coverage areas.

Strategic partnerships:

Carefully evaluate potential merger and acquisition (M&A) targets. For example, the Ecostar-Dish Network merger aims to create a leading wireless and satellite provider.

Satellite-as-a-Service (SaaS):

Partner with established SaaS providers. For example, Africa Mobile Networks (AMN) successfully partnered with Intelsat to deploy satellite infrastructure across Africa, connecting over 8 million people in rural areas.

How CSG BSS Solutions Can Fuel Your Satellite Go-to-Market Strategy

Our next-generation BSS solutions provide the flexibility, scalability and automation needed to streamline your satellite go-to-market strategy.

- Complex billing and pricing management: Streamline global business by enabling effortless monetization across borders with a single platform that handles regulations, currencies and local complexities.

- Seamless partner integrations: Establish efficient connections with satellite network operators (SNOs) and other key partners, ensuring a smooth flow of data and provisioning processes.

- Automated service activation and management: Automate routine tasks like order fulfillment, service activation, and billing, freeing your team to focus on strategic initiatives.

- Real-time rating and revenue management: Benefit from real-time capabilities to accurately track usage, generate invoices, and optimize your revenue streams for both terrestrial and satellite services.

- Customer experience tailored for the future: Deliver a superior customer experience with features like self-service portals for plan management and real-time usage insights.

Don’t wait to launch your satellite strategy.

Learn how our BSS solutions can empower you to capture your share of the booming satellite market.